预估税呈报

2020-08-16

新加坡公司种类

2020-08-17

Why Register a Singapore Company.

In the 14th century, it was said that when a Sumatran prince set foot on the island, he saw a magical beast that he later learned was a lion. In 1819, Stamford Raffles, an Englishman, shaped Singapore as a trading post, and Singapore’s free trade policy attracted merchants from all over Asia, even the United States and the Middle East. Singapore gained independence on August 9, 1965, and became a member of the United Nations in September of that year. It became a member of the United Nations in September of that year and joined the Commonwealth in October.

International Headquarters

Approximately 26,000 international companies

Financial Center

The fourth largest foreign exchange trading center in the world

R&D Center

Second worldwide in intellectual property protection

Singapore Talent Resources

Singapore’s workforce ranking holds steady at the top. The Business Environment Risk Institute (BERI) Workforce Assessment ranked Singapore number one. Singapore has a tradition of a productive and skilled workforce, making it a good location for business growth, with excellent business performance and advanced technology, low unit labour costs, and the production of high value goods and services. Has some of the best industrial relations in Asia. Employee-employer relations in the average Singapore workplace are among the best in the region. More open channels of communication and harmonious employer-employee relations, resulting in a better working environment and higher productivity in Singapore. Pro-business immigration regulations for foreign talent. Singapore’s convenient location makes it an ideal hub for foreign talent. According to a report by the International Institute of Management Lausanne, Singapore’s workforce policy is relatively open, very pro-business and values foreign talent. About a quarter of the skilled workers in Singapore come from overseas. Working in Singapore is tantamount to being part of an international workforce that is highly skilled, proficient in English and often has a command of other regional languages. The government and businesses also recognise the importance of providing ongoing training and career development opportunities for employees to improve their quality, productivity and skills. In the context of a globalised economy, all these factors have contributed to the appreciation and popularity of Singapore’s workforce.

Singapore – an international hub for economy and trade

· International companies: about 26,000

· Insurance financial institutions: more than 5000

· More than 1/3 of the World’s 500 has headquarters in Singapore

· More than 100 state-of-the-art software services companies worldwide, with more than 80 headquarters in Singapore

· Singapore signs 50 double taxation avoidance agreements and 30 investment guarantee agreements

· As one of the world’s largest foreign exchange markets, Singapore has a well-established financial system that attracts many regional financial centres to settle here.

Advantages of doing business in Singapore.

- Singapore tops the Global Business Environment for 9th consecutive year

- The world’s second most competitive countries in 2020

- 2020 World’s Freest Economy Ranked 2nd

- 2019 Global Investor Sentiment Survey Property Investment Prospects – Singapore No.1

Singapore Advantage Highlights

- Singapore’s relatively low corporate tax (currently 17% tax)

- Overseas companies can use Singapore as an R&D and IP platform

- Within a six-hour flight, Singapore covers half the world’s population.

- Home to some of the world’s largest banks and one of the leading international financial centers.

- No exchange controls in Singapore, making it easier for investors to cope with foreign exchange risk

- 新加坡吸引了大量国际性人才助力企业长远发展

- 成熟的信用体系,严格额商务规范,非常安全的经商国度

- 新加坡地处亚洲中心及东西贸易路线的交汇点,是卓越的贸易及物流中心

- 新加坡政府的透明度与当局倡导世界一流的准则,也将公司治理风险最小化

- 新加坡与其他国家签署了超过70项税收条约,良好控制了经营企业的成本

海外企业以新加坡为国际贸易平台的优势

- 新加坡经济开放,贸易自由

- 自由贸易协定(FTAs):新加坡拥有21个区域和双边自由贸易协定。通过自由贸易协定,海外企业在进出口及投资时可用享受诸多优惠政策

- 卓越的基础设施:新加坡卓越的基础设施和优越的地理位置,为海外企业的全球业务发展提供全面的服务配套;

- 低融资成本:新加坡融资便利且融资成本相对低,贸易利息低于2%;

- 申请全球贸易商计划(GTP),离岸贸易收入可享受10%或5%的税率;

早在2014年新加坡贸易总额就达到9847亿新元,预计到2020年,在亚洲的贸易量将占全球贸易总量的60%。地处于亚洲中心及东西贸易路线的交汇点,新加坡凭借优越的地理位置,成为一个重要门户,通往多个迅速发展的经济体,如中国、印度和东南亚(东盟它们与新加坡的距离均在七小时的飞行范围内),形成了庞大的通商网络和经济发展的腹地。

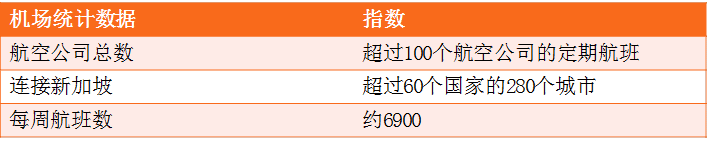

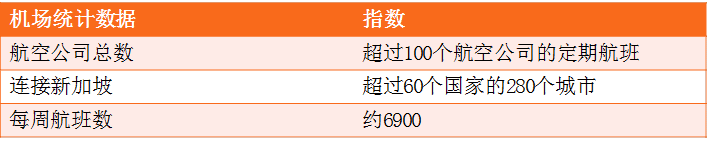

新加坡是全球最佳的货柜海运和空运枢纽之一,拥有最繁忙的货柜码头。樟宜国际机场的航班则链接60个国家的270座城市,每周航班超过6600趟次。无论是乘客还是货物都能迅捷地通往世界各地,交通畅行无阻。

海外企业以新加坡作为跨国投资平台的优势

- 新加坡是没有外汇管制;

- 新加坡拥有75个全方位的避免双重税收协定(DTAs),使海外企业的新加坡公司享有税收优势;

- 新加坡拥有42项投资保证协议(IGA);

- 海外赚取收入以股息形式发回新加坡,股息免税;

- 新加坡无资本增值税或资本收益税

- Singapore companies tax rate is 17%

新加坡作为国际金融中心为企业提供全面的融资方案

目前,新加坡拥有亚太地区,乃至全世界最成熟的资本市场,有多大600多加金融机构把总部设立在新加坡,其中包含诸多因素,如良好的国家信用、完善的政府监管机制,以及健全的法律制度。

投资于新加坡上市公司的国际投资人云集

新加坡广阔的资金募集市场空间

新加坡交易所仅2014年就多达41支股票和521支债券上市,包括再融资总共募集了高达1700亿美元。

在新加坡交易所上市的大型国际企业

与全球接轨的国际贸易中心

- 全球四大外汇市场,亚洲规模最大的新兴市场。

- 亚太地区领先的资产管理中心,管理资产超过131000亿美元。

- 全世界发展最快、最活跃的融资(债券)市场之一。

- 亚洲地区最成熟、最领先的金融衍生品场外交易市场。

- 国际领先的商铺贸易与定价中心。

- 人民币离岸结算中心。

新加坡有超过40000家国际企业,其中包括5000多家中国企业;5000多家印度企业,以及8300家除新加坡以外的东盟企业。世界500强中,有超过80%在新加坡设有据点或经营业务。

新加坡福智霖集团同新加坡知名大学和科研机构有长期合作,可以帮助客户对接许多尖端高科技技术的环保项目,包括污水处理,空气净化等,许多项目以其独有的专利技术已经在环保领域拓展到一定规模的市场并取得积极的市场反馈,同时,福智霖所对接的项目受到政府支持,享有政府津贴,这为技术的不断革新和市场的拓宽提供了很大便利。

新加坡 VS 中国香港

很多企业家朋友选择进军国际市场的时候,会考虑选择新加坡还是中国香港,毕竟两个地方都是国际金融中心,对于企业海外发展的金融支持力度较大。今天在这里和企业家朋友们一起来对比一下在新加坡注册公司和在香港注册公司的差别

1。新加坡地处太平洋与印度洋航运要道—马六甲海峡的出入口,注册新加坡公司其优越的地理位置与东西方文化的交融使它在世界经济贸易圈中拥有特殊的地位。新加坡不仅是重要的转口贸易中心,也是知名的国际金融中心.

- 新加坡常年被评为全球最易经商的国家之一

- 新加坡为世界知名金融中心,是企业融资发展的好地方

- 新加坡在全球最佳创新排行榜中占领先地位

- 新加坡在知识产权保护方面位居亚洲第一,世界第四

2。奉行法治及自由市场经济,信息自由流通,缔造出公平的竞争环境。香港金融中心的地位巩固,国际资金充裕,企业管治及监管水平高,是企业上市集资的最佳平台。香港位于亚洲中心,对外交通发达,区域枢纽地位无可置疑。香港的税负低廉,税制简单且透明,报税手续直接简易。香港是全球最方便营商的城市之一。

Singapore FOZL Group Pte. Ltd.

Accounting and Corporate Regulatory Authority of Singapore licensed corporate advisory firm.

Singapore Company Registration, Annual Return, Accounting & Tax

Trademark Registration, Corporate Advisory, Serviced Offices.

6 Raffles Quay,#14-02, #14-06, Singapore 048580

Why Register a Singapore Company.

In the 14th century, it was said that when a Sumatran prince set foot on the island, he saw a magical beast that he later learned was a lion. In 1819, Stamford Raffles, an Englishman, shaped Singapore as a trading post, and Singapore’s free trade policy attracted merchants from all over Asia, even the United States and the Middle East. Singapore gained independence on August 9, 1965, and became a member of the United Nations in September of that year. It became a member of the United Nations in September of that year and joined the Commonwealth in October.

International Headquarters

Approximately 26,000 international companies

Financial Center

The fourth largest foreign exchange trading center in the world

R&D Center

Second worldwide in intellectual property protection

Singapore Talent Resources

Singapore’s workforce ranking holds steady at the top. The Business Environment Risk Institute (BERI) Workforce Assessment ranked Singapore number one. Singapore has a tradition of a productive and skilled workforce, making it a good location for business growth, with excellent business performance and advanced technology, low unit labour costs, and the production of high value goods and services. Has some of the best industrial relations in Asia. Employee-employer relations in the average Singapore workplace are among the best in the region. More open channels of communication and harmonious employer-employee relations, resulting in a better working environment and higher productivity in Singapore. Pro-business immigration regulations for foreign talent. Singapore’s convenient location makes it an ideal hub for foreign talent. According to a report by the International Institute of Management Lausanne, Singapore’s workforce policy is relatively open, very pro-business and values foreign talent. About a quarter of the skilled workers in Singapore come from overseas. Working in Singapore is tantamount to being part of an international workforce that is highly skilled, proficient in English and often has a command of other regional languages. The government and businesses also recognise the importance of providing ongoing training and career development opportunities for employees to improve their quality, productivity and skills. In the context of a globalised economy, all these factors have contributed to the appreciation and popularity of Singapore’s workforce.

Singapore – an international hub for economy and trade

· International companies: about 26,000

· Insurance financial institutions: more than 5000

· More than 1/3 of the World’s 500 has headquarters in Singapore

· More than 100 state-of-the-art software services companies worldwide, with more than 80 headquarters in Singapore

· Singapore signs 50 double taxation avoidance agreements and 30 investment guarantee agreements

· As one of the world’s largest foreign exchange markets, Singapore has a well-established financial system that attracts many regional financial centres to settle here.

Advantages of doing business in Singapore.

- Singapore tops the Global Business Environment for 9th consecutive year

- The world’s second most competitive countries in 2020

- 2020 World’s Freest Economy Ranked 2nd

- 2019 Global Investor Sentiment Survey Property Investment Prospects – Singapore No.1

Singapore Advantage Highlights

- Singapore’s relatively low corporate tax (currently 17% tax)

- Overseas companies can use Singapore as an R&D and IP platform

- Within a six-hour flight, Singapore covers half the world’s population.

- Home to some of the world’s largest banks and one of the leading international financial centers.

- No exchange controls in Singapore, making it easier for investors to cope with foreign exchange risk

- 新加坡吸引了大量国际性人才助力企业长远发展

- 成熟的信用体系,严格额商务规范,非常安全的经商国度

- 新加坡地处亚洲中心及东西贸易路线的交汇点,是卓越的贸易及物流中心

- 新加坡政府的透明度与当局倡导世界一流的准则,也将公司治理风险最小化

- 新加坡与其他国家签署了超过70项税收条约,良好控制了经营企业的成本

海外企业以新加坡为国际贸易平台的优势

- 新加坡经济开放,贸易自由

- 自由贸易协定(FTAs):新加坡拥有21个区域和双边自由贸易协定。通过自由贸易协定,海外企业在进出口及投资时可用享受诸多优惠政策

- 卓越的基础设施:新加坡卓越的基础设施和优越的地理位置,为海外企业的全球业务发展提供全面的服务配套;

- 低融资成本:新加坡融资便利且融资成本相对低,贸易利息低于2%;

- 申请全球贸易商计划(GTP),离岸贸易收入可享受10%或5%的税率;

早在2014年新加坡贸易总额就达到9847亿新元,预计到2020年,在亚洲的贸易量将占全球贸易总量的60%。地处于亚洲中心及东西贸易路线的交汇点,新加坡凭借优越的地理位置,成为一个重要门户,通往多个迅速发展的经济体,如中国、印度和东南亚(东盟它们与新加坡的距离均在七小时的飞行范围内),形成了庞大的通商网络和经济发展的腹地。

新加坡是全球最佳的货柜海运和空运枢纽之一,拥有最繁忙的货柜码头。樟宜国际机场的航班则链接60个国家的270座城市,每周航班超过6600趟次。无论是乘客还是货物都能迅捷地通往世界各地,交通畅行无阻。

海外企业以新加坡作为跨国投资平台的优势

- 新加坡是没有外汇管制;

- 新加坡拥有75个全方位的避免双重税收协定(DTAs),使海外企业的新加坡公司享有税收优势;

- 新加坡拥有42项投资保证协议(IGA);

- 海外赚取收入以股息形式发回新加坡,股息免税;

- 新加坡无资本增值税或资本收益税

- Singapore companies tax rate is 17%

新加坡作为国际金融中心为企业提供全面的融资方案

目前,新加坡拥有亚太地区,乃至全世界最成熟的资本市场,有多大600多加金融机构把总部设立在新加坡,其中包含诸多因素,如良好的国家信用、完善的政府监管机制,以及健全的法律制度。

投资于新加坡上市公司的国际投资人云集

新加坡广阔的资金募集市场空间

新加坡交易所仅2014年就多达41支股票和521支债券上市,包括再融资总共募集了高达1700亿美元。

在新加坡交易所上市的大型国际企业

与全球接轨的国际贸易中心

- 全球四大外汇市场,亚洲规模最大的新兴市场。

- 亚太地区领先的资产管理中心,管理资产超过131000亿美元。

- 全世界发展最快、最活跃的融资(债券)市场之一。

- 亚洲地区最成熟、最领先的金融衍生品场外交易市场。

- 国际领先的商铺贸易与定价中心。

- 人民币离岸结算中心。

新加坡有超过40000家国际企业,其中包括5000多家中国企业;5000多家印度企业,以及8300家除新加坡以外的东盟企业。世界500强中,有超过80%在新加坡设有据点或经营业务。

新加坡福智霖集团同新加坡知名大学和科研机构有长期合作,可以帮助客户对接许多尖端高科技技术的环保项目,包括污水处理,空气净化等,许多项目以其独有的专利技术已经在环保领域拓展到一定规模的市场并取得积极的市场反馈,同时,福智霖所对接的项目受到政府支持,享有政府津贴,这为技术的不断革新和市场的拓宽提供了很大便利。

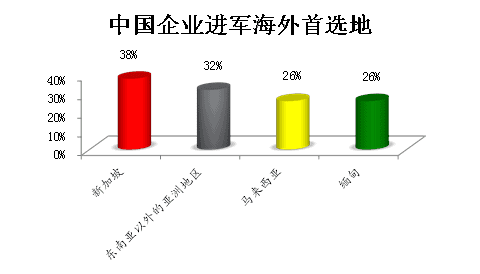

新加坡 VS 中国香港

很多企业家朋友选择进军国际市场的时候,会考虑选择新加坡还是中国香港,毕竟两个地方都是国际金融中心,对于企业海外发展的金融支持力度较大。今天在这里和企业家朋友们一起来对比一下在新加坡注册公司和在香港注册公司的差别

1。新加坡地处太平洋与印度洋航运要道—马六甲海峡的出入口,注册新加坡公司其优越的地理位置与东西方文化的交融使它在世界经济贸易圈中拥有特殊的地位。新加坡不仅是重要的转口贸易中心,也是知名的国际金融中心.

- 新加坡常年被评为全球最易经商的国家之一

- 新加坡为世界知名金融中心,是企业融资发展的好地方

- 新加坡在全球最佳创新排行榜中占领先地位

- 新加坡在知识产权保护方面位居亚洲第一,世界第四

2。奉行法治及自由市场经济,信息自由流通,缔造出公平的竞争环境。香港金融中心的地位巩固,国际资金充裕,企业管治及监管水平高,是企业上市集资的最佳平台。香港位于亚洲中心,对外交通发达,区域枢纽地位无可置疑。香港的税负低廉,税制简单且透明,报税手续直接简易。香港是全球最方便营商的城市之一。