【新加坡公司注册小知识】注册新加坡公司开启您的亚洲门户!新加坡福智霖集团黄泽霖董事介绍福智霖企业深度服务(附视频)

2017-02-24

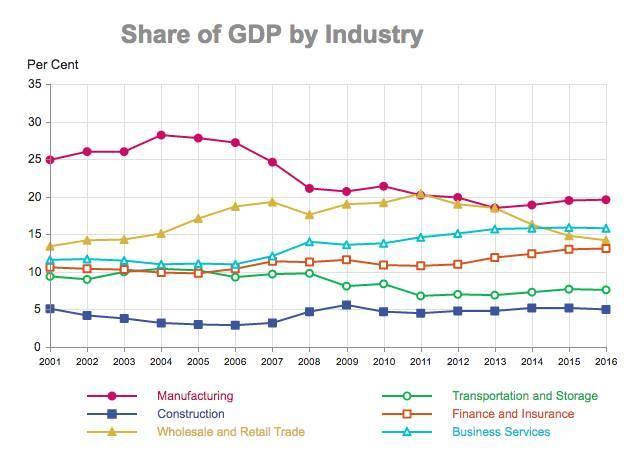

【新加坡公司注册小知识】来新加坡经商,怎可不了解新加坡制造业的发展情况:)

2017-03-08

预估税计算

公司在提交ECI时不需要考虑新初创公司的免税计划/部分免税和YA 2020公司所得税(CIT)退税。新加坡国内税务局IRAS将计算这些并允许新初创公司/部分免税和YA 2020 公司所得税(CIT)自动退税。

例:YA 2020的ECI计算

贵公司2019财政年度(2020评估年度)损益表如下:

| Sales | $80,000 |

| Less: Cost of goods sold | $(35,000) |

| Gross Profit | $45,000 |

| Other Income: | |

| Rental Income | $1,200 |

| Less: Expenses | |

| Advertisement | $(790) |

| CPF | $(2,300) |

| Depreciation | $(300) |

| Directors’ fees | $(9,000) |

| Printing and Stationery | $(290) |

| Property Tax (rental property) | $(300) |

| Salaries | $(24,000) |

| Secretarial Fees | $(310) |

| Transport ($200 was incurred on car SJX 123) | $(780) |

| Travelling Expenses | $(560) |

| Water & Electricity | $(925) |

| Net Profit before Tax | $6,645 |

该公司还在YA 2020年购买了一辆新的私家车(SJX 123),1,200新元的电脑和300新元的文件柜。没有以前的YA带来的未使用资本津贴。

公司ECI的计算如下:

| Net profit before Tax | $6,645 |

| Less: Separate Source Income | |

| Rental Income | $(1,200) |

| Add: Disallowable Expenses | |

| Depreciation | $300 |

| Property Tax (Rental Property) | $300 |

| Transport (S-plated car) | $200 |

| Adjusted profit before Capital Allowances | $6,245 |

| Less: Capital Allowances for YA 2020 1 | |

| 100% Write-Off for Low-Value Asset – Filing Cabinet | $(300) |

| 100% Write-Off in One Year for Computer | $(1,200) |

| Adjusted profit after Capital Allowances | $4,745 |

| Add: Separate Source Income | |

| Rental income (net of Property Tax for rental income) | $900 |

| Estimated Chargeable Income (before exempt amount) | $5,645 |

当电子申报ECI时,公司可以报告其收入为“80,000新元”,ECI在17%的税率类别下为“5645新元”。如公司亦有资格申请新成立公司的税务豁免计划,公司须在退税申报表的有关方格内作出相应说明。

新加坡福智霖集团有限公司

Singapore FOZL Group Pte. Ltd.

新加坡会计与企业管制局持牌的企业顾问事务所

注册新加坡公司 新加坡财务外包 新加坡税务优惠

商标注册 企业扶持政策咨询 服务式办公室

6 Raffles Quay,#14-02, #14-06, Singapore 048580

Singapore FOZL Group Pte. Ltd.

新加坡会计与企业管制局持牌的企业顾问事务所

注册新加坡公司 新加坡财务外包 新加坡税务优惠

商标注册 企业扶持政策咨询 服务式办公室

6 Raffles Quay,#14-02, #14-06, Singapore 048580