2018-01-23

Role of Trade Marks For many entrepreneurs, intellectual property may be an unfamiliar legal concept, and you may ask yourself why any small and medium-sized enterprises (SMEs) should pay attention to intellectual property issues? Or what benefits your SME can gain using the intellectual property system? Next, we will introduce Singapore’s intellectual property law. Together with human creativity and originality, intellectual property rights have always been around us. Every product or service we use in our daily lives is the result of a long list of innovations, large or small, such as changes in design, or improvements in product appearance […]

2018-01-08

Accounting Software The Singaporean government encourages enterprises to adopt digital technology to increase productivity. In accordance with Singapore’s accounting standards and tax calculation and reporting requirements, the Inland Revenue Authority of Singapore provides the public with a list of registered accounting software to facilitate the market in selecting accounting software that is suitable and meets tax compliance requirements. List of 57 accounting software registered in Singapore Tax (provided by the IRAS) Software name A2000 Solutions A2000ERP Software Version 12.X* AccPro Accounting Systems Pte Ltd Professional Version 10.0 ACMEFOCUS.NE WHIZIT ACCOUNTS ORGANIZER Asian Business for Windows Release for SG […]

2018-01-03

Audit Exemption The following companies are exempted from financial statement audits if they meet the specific requirements of the Singapore Companies Act. However, they are still required to prepare financial statements (and consolidated financial statements, if applicable) that comply with the Companies Act and IFRS. In order to reduce the institutional burden on small companies and to move towards a risk-based regime, the concept of small companies and their exemption from audit requirements were introduced in amendments to the Companies Act. The new audit exemption regime applies to Singapore companies incorporated after 1 July 2015 or with a financial year […]

2017-12-12

Dependant Pass DP, or Dependant’s Pass in full, is equivalent to the Chinese family pass. Those who work or do business in Singapore and hold EP, SP or Entrepass can apply for a family pass for their spouse and children under the age of 21. Children with family passes can directly enter the Singapore government primary and secondary schools. What are the application requirements? To be eligible, you need: An income of at least S $ 6,000 per month. To hold an employment pass. These are the family members you can bring in and the types of passes they […]

2017-12-08

Annual General Meeting The Singapore Companies Act requires companies to hold an annual general meeting (AGM) unless the company elects not to hold an AGM by passing a shareholders’ resolution. If the company chooses not to hold an AGM, all matters to be transacted at the AGM can be resolved by way of a written resolution. What is an AGM The Annual General Meeting of Shareholders is a meeting of shareholders held at specified intervals during each calendar year. This meeting gives the company’s shareholders the right to participate in certain decisions that require the company’s approval. One of the […]

2017-10-05

Pay Withholding Tax How to Pay Withholding Tax GIRO is the preferred method of payment. GIRO Majority of taxpayers use GIRO for tax payment. Electronic Payment Modes PayNow QR New! Internet Banking Bill Payment Internet Banking for tax payment is made available by the following banks: BOC CIMB Citibank DBS/POSB HSBC ICBC MayBank OCBC RHB Standard Chartered Bank State Bank of India UOB (BOC, CIMB, Citibank, ICBC, MayBank, RHB and State Bank of India are applicable for individual account holders only). DBS PayLah! Mobile App Pay your tax via DBS PayLah! Phone Banking Phone Banking service for DBS/POSB, OCBC and UOB account holders who have subscribed to this service. (DBS/POSB and OCBC are applicable for individual account […]

2017-10-02

File Personal Income Tax Obligation to File Tax Notification to File Income Tax Return You must file an Income Tax Return if you receive a letter, form or an SMS from IRAS informing you to do so. It does not matter how much you earned in the previous year or whether your employer is participating in the Auto-Inclusion Scheme (AIS) for Employment Income. To file your tax return, please log into myTax Portal using your SingPass. Filing Due Dates Mode of Filing Filing Deadline e-Filing 18 Apr 2020 (Extended to 31 May 2020) New Paper Filing 15 Apr 2020 (Extended to 31 May […]

2017-09-11

Pay ECI Pay Taxes in Instalments through GIRO Only companies that are on GIRO are allowed to pay their taxes in instalments. Companies that do not have an existing GIRO arrangement for Corporate Tax are encouraged to apply for GIRO at least 3 weeks before e-Filing their ECI. If the GIRO arrangement is not approved before the payment due date, the company will not be eligible for instalment payment and will need to pay the full amount of estimated tax by the payment due date. You can check the status of your company’s GIRO application through the Corporate Tax Integrated Phone Service (PDF, 371KB). As announced […]

2017-09-07

What is ECI Definition of ECI ECI is an estimate of the company’s taxable income (after deducting tax-allowable expenses) for a Year of Assessment (YA). For details of taxable income and tax-allowable expenses, refer to Taxable and Non-Taxable Income and Business Expenses. Declaration of revenue in ECI Form Besides stating the ECI, you have to declare the company’s revenue in the ECI Form. This declaration is compulsory with effect from Jan 2017. Revenue refers to a company’s main source of income, and excludes items like gain on disposal of fixed assets. If your company is an investment holding company, your main source of […]

2017-08-22

Who Need to File ECI Compulsory e-Filing for ECI From YA 2020, e-Filing of the ECI is compulsory for all companies. In line with Government’s direction for more cost effective delivery of public services and the Smart Nation vision to harness technology to enhance productivity, e-Filing of the Corporate Income Tax returns (including ECI, and Form C-S/ C) is compulsory. A phased approach is adopted from YAs 2018 to 2020 as follows: YA Target Group for Compulsory e-Filing 2018 onwards Companies with revenue more than $10 million in YA 2017 2019 onwards Companies with revenue more than $1 million in YA 2018 2020 onwards All […]

2017-08-15

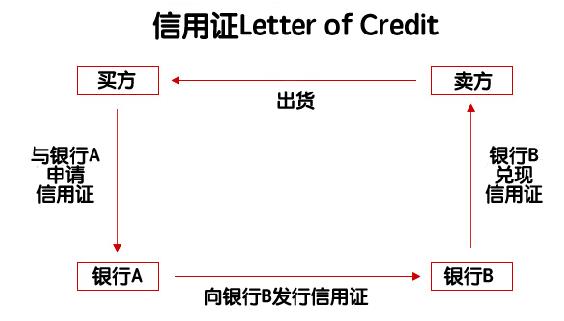

Letter of Credit What is a letter of credit? A letter of credit (LC) is a commonly used trade finance tool to ensure that payment for goods and services will be made between the buyer and the seller. The rules for LCs are issued and defined by the International Chamber of Commerce (ICC) through its Uniform Documentary Letter of Credit Practice (ucp600), which is used by producers and traders worldwide. The parties issue the letter of credit through an intermediary, a bank or financial institution, and are legally guaranteed that the goods or services received will be paid for. The […]

2017-08-10

EP Application Process After overseas companies set up wholly-owned subsidiaries or joint ventures in Singapore, most will consider sending employees to work in Singapore, so naturally they would want information about applying for work visas for company executives. FOZL will share the relevant information with you today! The Singapore Employment Pass (EP) is a work pass provided by the Ministry of Manpower to foreign professionals (in management, supervisor or professional positions). According to the relevant regulations of the Ministry of Manpower of Singapore, from December 1, 2020, the application conditions of the Employment Pass (EP) have undergone new changes, […]

2017-05-08

Corporate Tax Computation Requirement to Submit Tax Computation A tax computation is a statement showing the tax adjustments to the accounting profit to arrive at the income that is chargeable to tax. Tax adjustments include non-deductible expenses, non-taxable receipts, further deductions and capital allowances. Companies should prepare their tax computations annually before completing the Form C-S/ C. Only companies filing Form C need to submit their audited/unaudited* financial statements, tax computation and supporting schedules together with Form C. Companies filing Form C-S are still required to prepare their financial statements, tax computation and supporting schedules and submit them to IRAS […]