EPOL Account

2019-02-21

Trade Finance

2019-03-21

13R & 13X

Singapore is also the preferred domicile for a growing number of investment institutions. This is due to the excellent growth of the fund management industry in Singapore, which can be attributed to several factors, including the ease of doing business in Singapore and the attractive tax incentives for funds and fund managers. Outside of traditional offshore fund jurisdictions such as the Cayman Islands, Singapore’s regulatory and tax regime for funds is considered to be one of the most attractive in the world.

For funds managed by onshore fund managers in Singapore, some of the fund’s income may be deemed to be generated in Singapore as the fund management process takes place in Singapore. Therefore, the fund may be subject to tax in Singapore under Singapore tax laws. However, funds may be exempt from tax under the Fund Tax Incentive Scheme if they meet certain conditions.

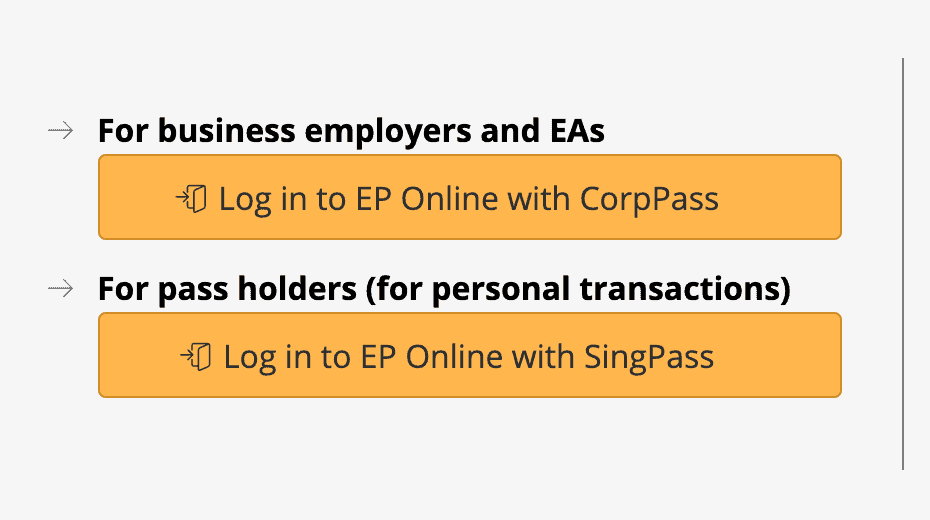

Under Singapore’s fund tax scheme, funds managed by onshore fund managers in Singapore are exempt from tax on certain income earned from specified investments. Funds approved before 31 December 2024 will enjoy tax-free treatment for life if they continue to meet the terms of the tax exemption. The tax exemption policy is as follows:

| Tax exemption for offshore funds

13AC |

Tax exemption for onshore funds

13R |

Enhanced fund tax exemption policy 13X | |

| Tax exemption | Exemption of specific income from specified investments | ||

| The legal form of the fund | Companies, trusts, and individuals | Companies registered in Singapore | Any form of fund |

| Fund tax residence | Except for Singapore fund managers, the fund does not include Singapore tax residents and does not operate physically in Singapore | Must be a Singapore tax resident | no limit |

| Variable capital company | No | can | can |

| Fund manager | Singapore is onshore and holds a fund management license issued by the Authority (unless it is exempt from holding a license). Also, 13X requires funds to be directly managed or advised by Singapore’s fund managers, and fund companies must hire at least three investment professionals. | ||

| Investors | Cannot be 100% owned by Singapore investors. | Unlimited | |

| Amount of assets under management | Unlimited | Unlimited | At least S $ 50 million |

| Annual Fund Expenditure | Unlimited | At least S $ 200,000 per year | At least S $ 200,000 per year |

| Approval requirements | No approval required | Requires Monetary Authority of Singapore approval

The investment strategy cannot be changed after approval |

|

| Financial report | Provide annual reports to investors | Provide annual reports to investors | no request |

| Claim tax | Basically no requirements | File a tax with the tax office | File a tax with the tax office |

Accounting and Corporate Regulatory Authority of Singapore licensed corporate advisory firm.

Singapore Company Registration, Annual Return, Accounting & Tax

Trademark Registration, Corporate Advisory, Serviced Offices.

6 Raffles Quay,#14-02, #14-06, Singapore 048580