为什么注册新加坡公司

2020-08-17

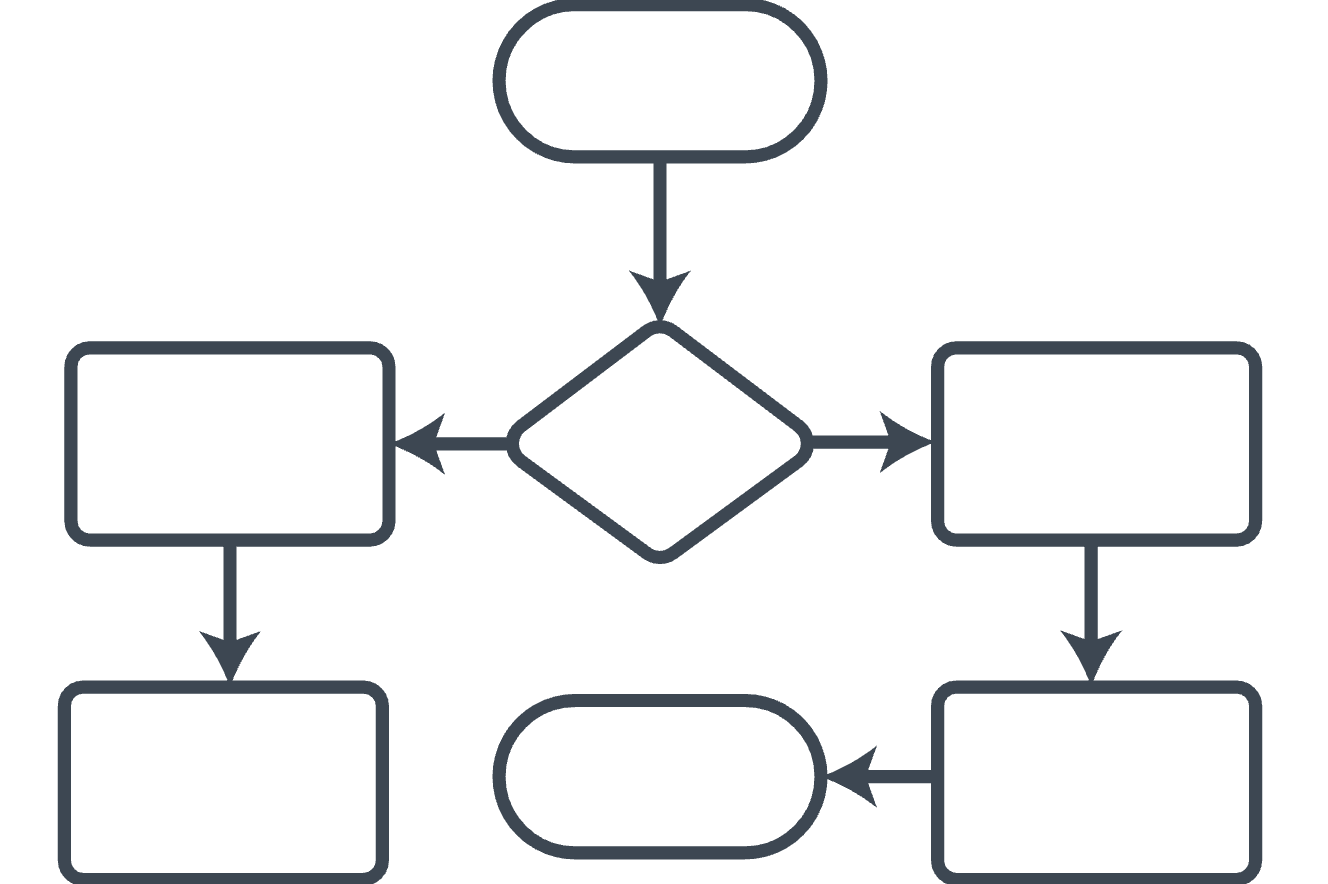

Incorporation Process

2020-08-17

Singapore Company Types

There are many types of business entities in Singapore. Before registering, you should be aware of the kind of business entity that is best for your company.

According to the Singapore Business Registration Act, all individuals or institutions conducting business in Singapore are required to register with the Accounting and Corporate Regulatory Authority (ACRA), and any details about changes in the owner, managers or business partners must be made known to ACRA within the specified time period.

Singapore corporations include private and public limited companies

- Private limited companies can be registered with less than 50 shareholders

- Public companies with more than 50 shareholders must register.

A private limited company is the most common and widely used form of business in Singapore and it is an independent legal entity. Each shareholder has limited liability to the company.

A subsidiary is also a type of limited liability company.

Exempt private company

An exempted private company is a type of private limited company, the number of shareholders of which cannot exceed 20, and the shares cannot be held by the company. Exempted private companies are required to prepare unaudited statements, also known as accountant-edited reports, for submission to the Annual General Meeting of Shareholders (AGMs) and Singapore Accounting and Enterprise Regulatory Authority (ACRA) for the record.

Branch of an overseas company in Singapore

Overseas companies set up a branch in Singapore, which is an extension of the head office. Legally, the branch office and the head office are integrated. The head office has unlimited liability for the branch. However, in some cases, the branch company can use the qualification or project case of the head office. For example: construction company.

Representative Office of Overseas Company in Singapore

This is a representative office established by an overseas company in Singapore. Representative offices can conduct business market research or coordinate work, but they cannot engage in commercial activities.

Differences between a limited liability company, a representative office and a branch

| Kind | Singapore limited liability company | Singapore Representative Office | Singapore Branch |

| Institution name | Company name can be different from head office | Company name must be the same as the head office | Company name must be the same as the head office |

| Agency business scope | Can engage in various businesses | Can only conduct market research or coordinate activities | Must be the same as the parent company |

| Suitable for | For local or foreign companies wishing to expand their business in Singapore | For foreign companies wishing to set up a temporary agency in Singapore to conduct research and act as a liaison office | For foreign companies looking to expand their business in Singapore |

| Disadvantage | Ongoing compliance obligations, such as financial reporting, audits, etc. | It is a temporary agency and cannot generate income | Ongoing compliance obligations, such as financial reporting, audits, etc. |

| Ownership | Can be 100% local or 100% foreign | No ownership | 100% owned overseas |

| Independent legal | Yes | no | no |

| Maximum number of shareholders in the company | Unlimited shareholders | Not applicable | Not applicable |

| Established minimum requirements | At least one shareholder, which can be a 100% local or foreign shareholding of an individual or company, must have at least one local director | Must appoint a Chief Representative who moves from headquarters to Singapore | Must have at least one resident agent |

| Limited Liability | Yes | Is not | Is not |

| Audit requirements | Need audit | No need | Need audit |

| Annual review and tax filing | need | No need | need |

| Annual declaration | Must submit audit report of subsidiary | Not applicable | Must submit audit reports of branches and parent companies |

| Tax treatment | Tax as a Singapore tax resident entity and receive local tax benefits | Not applicable | Taxation as a non-tax resident entity, local tax benefits are not available |

| Expiration date | Persistent until logout | Up to 3 years | Persistent until logout |

Sole proprietorship (self-employed)

This is a business entity for Singapore citizens or Singapore permanent residents. Such business entities have joint and unlimited liability with individuals.

General Partner

A general partnership must be a sole proprietorship and a general partnership that is not a legal entity; that is, the sole proprietor and partners of the partnership assume unlimited liability for the debts and obligations that arise in the course of the business.

Limited Partnership

A limited partnership is not an independent legal entity. A limited partnership must have at least two partners, a general partner and a limited partner. General partners are responsible for all the debts and obligations of the limited partnership, while limited partners are only responsible for the debts and obligations within the scope of their agreed capital contribution.

Limited Liability Partnership

Must be registered with the Singapore Accounting and Corporate Regulatory Authority under the Singapore Limited Liability Partnership Act 2005. A limited liability partnership is essentially a partnership with limited liability. A limited liability partnership is a legal entity with legal personality independent of its partners. The partners of a limited liability partnership have limited liability for the debts and obligations incurred by the enterprise.

Singapore Company Type

There are many types of business entities in Singapore. Before you register, you should be aware of what kind of business entity is best for you.

According to the Singapore Business Registration Act, all individuals or institutions conducting business in Singapore are required to register with the Singapore Accounting and Corporate Regulatory Authority (ACRA), and any details about changes to the owner, manager or business partner Must notify the Singapore Accounting and Corporate Regulatory Authority within the required time.

Singapore corporations include private limited companies and public limited companies

- Private limited companies can be registered with less than 50 shareholders

- Public companies with more than 50 shareholders must register.

A private limited company is the most common and widely used form of business in Singapore and it is an independent legal entity. Each shareholder has limited liability to the company.

A subsidiary is also a type of limited liability company.

Exempt private company

An exempted private company is a type of private limited company. The number of shareholders in an exempt private company cannot exceed 20, and these shares cannot be held by the company. Exempted private companies are required to prepare unaudited statements, also known as accountant-edited reports, for submission to the Annual General Meeting of Shareholders (AGMs) and Accounting and Corporate Regulatory Authority (ACRA) for recording purposes.

Branch of an overseas company in Singapore

Overseas companies can set up a branch in Singapore, which is an extension of the head office. Legally, the branch office and the head office are integrated. The head office has unlimited liability for the branch. However, in some cases, the branch company can use the qualification or project case of the head office, for example, construction companies.

Representative Office of Overseas Company in Singapore

This is a representative office established by an overseas company in Singapore. Representative offices can conduct business market research or coordinate work, but they cannot engage in commercial activities.

Differences between a limited liability company, a representative office and a branch

| Type | Limited liability company in Singapore | Singapore Representative Office | Singapore Branch |

| Institution name | The company’s name can differ from the head office’s | The company’s name must be the same as the head office’s | The company’s name must be the same as the head office’s |

| Agency business scope | Can engage in various businesses | Can only conduct market research or coordinate activities | Must be the same as the parent company |

| Suitable for | Local or foreign companies wishing to expand their businesses in Singapore | Foreign companies wishing to set up a temporary agency in Singapore to conduct research and act as a liaison office | Foreign companies looking to expand their business in Singapore |

| Disadvantages | Ongoing compliance obligations, such as financial reporting, audits, etc. | It is a temporary agency and cannot generate income | Ongoing compliance obligations, such as financial reporting, audits, etc. |

| Ownership | Can be 100% local or 100% foreign | No ownership | 100% foreign ownership |

| Independent legal | Yes | No | No |

| Maximum number of shareholders in the company | Unlimited shareholders | Not applicable | Not applicable |

| Established minimum requirements | At least one shareholder (a local or foreign individual or company), must have at least one local director | Must appoint a Chief Representative who will move from the headquarters to Singapore | Must have at least one resident agent |

| Limited Liability | Yes | No | No |

| Audit requirements | Required | Not Required | Not Required |

| Annual review and tax filing | Required | Required | Required |

| Annual declaration | Must submit audit report of subsidiary | Not applicable | Must submit audit reports of branches and parent companies |

| Tax treatment | Will be taxed as a Singapore tax resident entity and receive local tax benefits | Not applicable | Taxation as a non-tax resident entity, local tax benefits are not available |

| Expiration date | Persists till cessation of business | Up to 3 years | Persists till cessation of business |

Sole proprietorship (self-employed)

This is a business entity for Singapore citizens or Singapore permanent residents. Such business entities have joint and unlimited liability with individuals.

General Partner

A general partnership must be a sole proprietorship and a general partnership that is not a legal entity; that is, the sole proprietor and partners of the partnership assume unlimited liability for the debts and obligations that arise in the course of the business.

Limited Partnership

A limited partnership is not an independent legal entity. A limited partnership must have at least two partners, a general partner and a limited partner. General partners are responsible for all the debts and obligations of the limited partnership, while limited partners are only responsible for the debts and obligations within the scope of their agreed capital contribution.

Limited Liability Partnership

Must be registered with the Singapore Accounting and Corporate Regulatory Authority under the Singapore Limited Liability Partnership Act 2005. A limited liability partnership is a legal entity with legal personality independent of its partners. The partners of a limited liability partnership have limited liability for the debts and obligations incurred by the enterprise.

Accounting and Corporate Regulatory Authority of Singapore licensed corporate advisory firm.

Singapore Company Registration, Annual Return, Accounting & Tax

Trademark Registration, Corporate Advisory, Serviced Offices.

6 Raffles Quay,#14-02, #14-06, Singapore 048580