2017-04-17

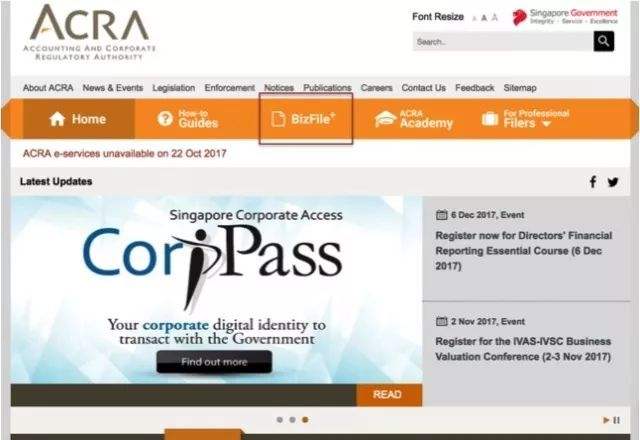

CorpPass Account ACRA, the Accounting and Corporate Regulatory Authority of Singapore, has recently amended its regulations. After 1 January 2018, companies will need to use CorpPass to log into the ACRA website for any transactions, and Singpass can no longer be used. From 25 March 2017, all Singaporean businesses will be required to use the new corporate digital identity, CorpPass, to conduct relevant online business with the Accounting and Corporate Regulatory Authority of Singapore (ACRA). CorpPass aims to replace Singpass as the platform for business entities to conduct business. By separating the login IDs used for corporate and personal […]

2017-03-28

Pay Personal Income Tax How to Pay Personal Income Tax GIRO is the preferred method of payment. GIRO Majority of taxpayers use GIRO for tax payment. Electronic Payment Modes PayNow QR New! Internet Banking Bill Payment Internet Banking for tax payment is made available by the following banks: BOC CIMB Citibank DBS/POSB HSBC ICBC MayBank OCBC RHB Standard Chartered Bank State Bank of India UOB (BOC, CIMB, Citibank, ICBC, MayBank, RHB and State Bank of India are applicable for individual account holders only). DBS PayLah! Mobile App Pay your tax via DBS PayLah! Phone Banking Phone Banking service for DBS/POSB, OCBC and UOB account holders who have subscribed to this service. (DBS/POSB and OCBC are applicable for individual […]

2017-03-01

Calculation of ECI Companies need not factor in the Tax Exemption Scheme for New Start-Up Companies/ Partial Tax Exemption and the YA 2020 Corporate Income Tax (CIT) rebate when filing their ECI. IRAS will compute these and allow the New Start-Up Companies/ Partial Tax exemption and YA 2020 CIT rebate automatically. Example: Calculation of ECI for YA 2020 Your company’s Profit and Loss statement for financial year 2019 (Year of Assessment 2020) is as follows: Sales $80,000 Less: Cost of goods sold $(35,000) Gross Profit $45,000 Other Income: Rental Income $1,200 Less: Expenses Advertisement $(790) CPF $(2,300) Depreciation $(300) Directors’ fees $(9,000) Printing and […]

2017-02-15

EP Renewal EP (Employment Pass) is a work pass issued by the Singapore government to attract more foreign professional and technical talents for new employment. It is also the highest-level work pass issued by Singapore’s Ministry of Manpower. After issuance, applicants have no entry and exit restrictions during their stay, and the permits can be renewed after they have expired, as long as the applicant is still employed. When to renew You can apply for renewal up to six months before the EP expires. You must apply before the expiry date. For Employment Pass EP (sponsorship): You can start applying […]

2017-01-27

Current GST Rates The current GST rate in Singapore is 8%. GST-registered businesses are required to charge and account for GST at 8% on all sales of goods and services in Singapore unless the sale can be zero-rated or exempted under the GST law. Historical GST Rates GST was introduced in Singapore on 1 Apr 1994. Year GST Rate 1 Apr 1994 to 31 Dec 2002 3% 1 Jan 2003 to 31 Dec 2003 4% 1 Jan 2004 to 30 Jun 2007 5% 1 Jul 2007 to 31 Dec 2022 7% 1 Jan 2023 to 31 Dec 2023 8% 1 […]

2016-10-28

Registered Address To register a company, you need a registered address in Singapore so that the company can be contacted via mail. However, it is not necessary for the registered office address to be the place where the business operates. Some companies, especially smaller companies or companies with offshore operations, may use the address of their business secretarial company as their registered office for a fee. A company with the above arrangement must confirm the contractual arrangements with its business secretarial company to ensure that the line of communication is not broken. Under the Singapore Companies Act, if a […]