CorpPass Account

2017-04-17

Corporate Tax Computation

2017-05-08

Why Prepare Financial Statements?

1. This is a legal requirement in Singapore. Section S201 of the Singapore Companies Act requires the directors of a company to prepare financial statements that comply with the “Singapore Accounting Standards”.

2. The Inland Revenue Authority of Singapore requires companies registered in Singapore to prepare financial statements and tax computations for filing corporation tax annually. In recent years, if your company is eligible to file Form C-S, you are not required to file your financial statements with the Inland Revenue Authority of Singapore (IRAS). However, the IRAS has made it clear that you are required to continue to keep records of your financial reports and tax computations even though you are not required to file them with your Form C-S.

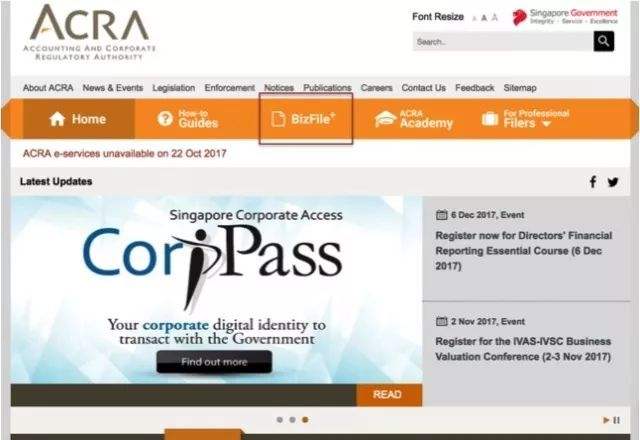

3. If your company does not qualify for audit exemption, or if it does qualify for audit exemption but becomes insolvent, you will be required to submit your financial statements to ACRA, the Accounting Corporate Regulatory Authority of Singapore, within the specified annual filing deadline.

4. Financial statements are essentially like report cards for a company’s financial performance and the information they provide is extremely valuable to the owners of the company as well as its directors when assessing the company’s future plans.

5. When you intend to sell shares in a company to other investors, you will need to pay stamp duty, and part of the calculation of stamp duty requires the use of financial statements to calculate the net asset value of the company.

6. If you have taken out a business or property loan, you may need a copy of your financial statements as part of your refinancing process.

Accounting and Corporate Regulatory Authority of Singapore licensed corporate advisory firm.

Singapore Company Registration, Annual Return, Accounting & Tax

Trademark Registration, Corporate Advisory, Serviced Offices.

6 Raffles Quay,#14-02, #14-06, Singapore 048580