Taxable and Non-Taxable Income

2018-03-01

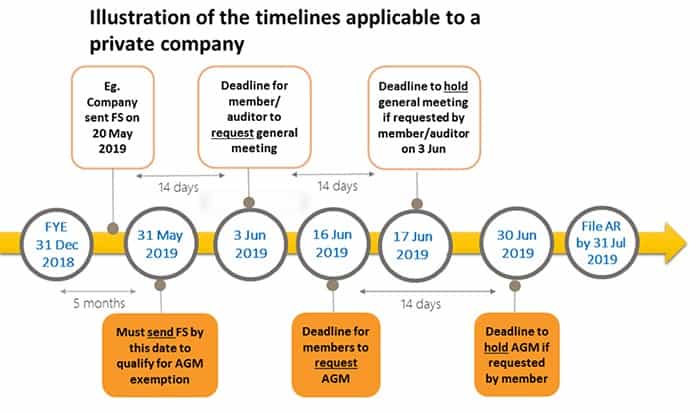

Annual Return Timeline

2018-03-07

GST Registered Company

GST Registered Company

With effect from 1 January 2019, your company should register for GST if its annual taxable turnover exceeds S $1 million during the 12-month period ending each calendar year. That is, your company must register for GST if it is determined that its taxable income will exceed S$1 million in the next 12 months.

The projections must be supported by the following documents.

- Signed contracts or agreements

- Accepted quotations or confirmed purchase orders from customers

- Invoices to customers

- Past P&L statements showing annual turnover of nearly S $1 million for the past 12 months and an increasing trend for the annual turnover

If your annual GST taxable income exceeds S $1 million, you must register for GST. If you are not liable for GST registration, you may choose to voluntarily register for GST.

Charging GST

Once you have registered for GST, you have to collect GST on goods at the prevailing rate. The GST collected is known as output tax, and it must be paid to the Inland Revenue Authority of Singapore.

The GST that you incur on business purchases and consumption (including import of goods) is called input tax. If your business qualifies for input tax exemption, you can claim an input tax exemption amount for your business purchases and consumption.

This input tax credit mechanism ensures that only the value added is taxed at each stage of the supply chain.

Example 1: How an enterprise collects output taxes and claims input tax exemptions

A GST registered manufacturer imports leather from overseas to manufacture bags. The manufacturer sells the bags to a GST-registered retailer. Thereafter, the retailer sells the bags to consumers.

How GST works at each stage of this value chain.

| 1. Manufacturer | Pay GST to Singapore Customs to import leather

Import value = 100SGD Import GST paid = 7% X 100SGD = 7 SGD (input tax to claim from IRAS). Collection of GST from retailers for sale of bags Price of sales to retailers = 200SGD GST collected from retailers = 7% X 200SGD = 14 SGD (output tax payable to IRAS). |

| 2. Retailer | Pay GST to the manufacturer to purchase the bag

Purchase value = 200 SGD GST payment = 7% X 200 SGD = 14SGD (input tax to claim from IRAS) Collecting GST from end consumers to sell bags Selling price to end consumers = $300 GST collected from end consumers = 7% X $300 = $21 (output tax payable to IRAS) |

| 3. Consumer | Pay GST to retailers to buy bags

Purchase value = $ 300 GST payment = 7% X $300 = $21 The end consumer is not a GST-registered business. Therefore, consumers cannot claim GST exemption from the Inland Revenue Authority of Singapore (IRAS). |

Payment of output tax and claim of input tax exemptions

As a GST registered business.

1. You must submit your GST return to the Inland Revenue Authority of Singapore (IRAS) within one month after the end of each prescribed accounting period. This is usually done on a quarterly basis.

You should report both your output tax and input tax in your GST return

The difference between the output tax and input tax is the net GST payable to IRAS or refunded by IRAS.

Accounting and Corporate Regulatory Authority of Singapore licensed corporate advisory firm.

Singapore Company Registration, Annual Return, Accounting & Tax

Trademark Registration, Corporate Advisory, Serviced Offices.

6 Raffles Quay,#14-02, #14-06, Singapore 048580