GST Registered Company

2018-03-02

Audit Process

2018-03-07

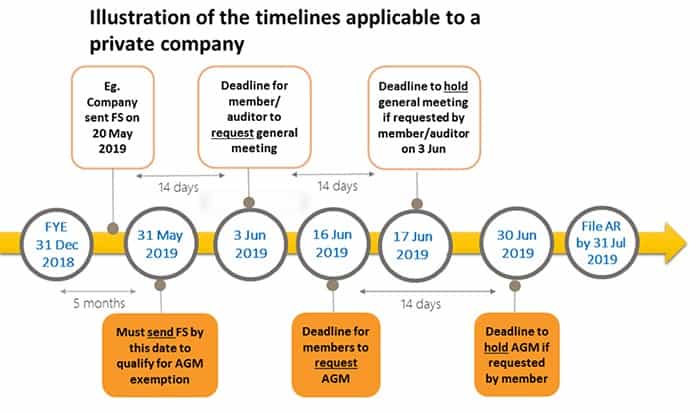

Annual Return Timeline

In accordance with the relevant provisions of the Singapore Companies Act Cap 175, 197, 201, a company whose financial year ends after 31 August 2018 is required to file its annual return on time.

For newly registered companies, the first financial year must end within 18 months. The financial year of a company in Singapore is calculated on the basis of 12 natural months.

After the end of the company’s financial year:

- Listed companies :

- Must hold a general meeting of shareholders of the company within 4 months.

- The annual return must be submitted within 5 months.

- Unlisted companies.

- The general meeting of shareholders must be held within 6 months.

- The annual return must be submitted within 7 months.

Based on actual operating conditions and experience, to avoid incurring unnecessary delays or penalties, FOZL strongly advises companies to complete the company’s bookkeeping and annual audit process early.

- Companies are required to file an ECI with the IRAS, which must be filed within 3 days after the end of the company’s fiscal year. Therefore, the company needs to complete its accounts before the tax return is due.

- Once the company has completed its financial statements, the directors must sign off on them. If the company chooses not to hold a general meeting, the documents need to be circulated to each shareholder and director, so that they may sign off on them. This process may take some time.

Singapore FOZL Group Pte. Ltd.

Accounting and Corporate Regulatory Authority of Singapore licensed corporate advisory firm.

Singapore Company Registration, Annual Return, Accounting & Tax

Trademark Registration, Corporate Advisory, Serviced Offices.

6 Raffles Quay,#14-02, #14-06, Singapore 048580

Accounting and Corporate Regulatory Authority of Singapore licensed corporate advisory firm.

Singapore Company Registration, Annual Return, Accounting & Tax

Trademark Registration, Corporate Advisory, Serviced Offices.

6 Raffles Quay,#14-02, #14-06, Singapore 048580