2018-06-13

Trade Mark Application Process The Trade Mark Law of Singapore was established in 1998 and came into force in January 1999. Singapore is a member of the World Trade Organization (WTO). It acceded to WIPO in 1990, the Paris convention in 1995 and the Madrid Protocol in 2000. The validity of Singapore trade mark The effective period of the registered trade mark is 10 years from the date of application. If the registered trade mark needs to be used after the expiry date, the right holder should apply for trade mark renewal 6 months before the expiry date. Each renewal […]

2018-06-12

What is a Statutory Secretary? When you register a company in Singapore, you need a statutory secretary. All companies registered in Singapore are required to have a company secretary who is a resident of Singapore. It is the responsibility of the company’s board of directors to appoint a qualified company secretary, and determine their salary package. The position of Statutory Secretary of the Company may only be vacated in the event of the Secretary’s death, resignation or dismissal by decision of the directors. In the event that this happens, it is important that the position be filled within six […]

2018-06-06

Who Needs To Pay Income Tax Essential information for individuals who are required to pay Income Tax. Obligation to Pay Income Tax All individuals earning, deriving or receiving income in Singapore need to pay income tax every year, unless specifically exempted under the Income Tax Act or by an Administrative Concession. Individuals are taxed based on the income earned in the preceding calendar year. This means that income earned in the calendar year 2019 will be taxed in the Year of Assessment (YA) 2020. Individuals Working in Singapore All individuals who receive payments (whether in the form of […]

2018-06-04

Application Requirements Applications are open to all nationalities. Who is eligible The Employment Pass is for foreign professionals who: Have a job offer in Singapore. Work in a managerial, executive or specialised job. Earn a fixed monthly salary of at least $4,500 (older, more experienced candidates need higher salaries). Have acceptable qualifications, usually a good university degree, professional qualifications or specialised skills. Application for an Employment Pass is open to all nationalities. Use the Self-Assessment Tool (SAT) to check if the candidate qualifies for the pass. Salaries for younger or older candidates From 1 May 2020, the minimum qualifying salary will be $4,500 […]

2018-06-01

What Is Withholding Tax Withholding Tax Under Singapore law, a person (known as the Payer) who makes payment(s) of a specified nature (e.g. Royalty, Interest, Technical Service Fee, etc.) to a non-resident company or individual (known as Payee) is required to withhold a percentage of that payment and pay the amount withheld(called ‘Withholding Tax’) to IRAS. What Are The Payments to a Non-Resident that Require You to Withhold Tax Payments for Services, Interest, Royalty, Rental of Movable Properties, etc. Payments to Non-Resident Directors, Professionals, Public Entertainers & International Market Agents Foreigners/PRs Withdrawing from Supplementary Retirement Scheme (SRS) Account Distribution of […]

2018-05-31

Applicant’s Documents EP applicants are required to prepare the following documents: A personal details page in the applicant’s passport, or one of the following if the name in the passport differs from other documents: Letter of explanation and supporting documents such as deeds An affidavit An up-to-date business overview or instant information about the company’s registration with ACRA Educational credentials, such as degrees Edu Cert Additional Documents Required India A complete transcript or mark sheet indicating the university the applicant attended. China Documentary evidence of diplomas and higher qualifications obtained from the following sources: Academic Qualifications: China Center for Higher […]

2018-05-31

Trade Mark Renewal The effective period of the registered trade mark is 10 years from the date of application. If the registered trade mark needs to be used after the expiry date, the right holder should apply for trade mark renewal 6 months before the expiry date. Each renewal is valid for 10 years. Although it is not necessary to register a trade mark to use it, trade mark registration adds tremendous value to enterprises. By obtaining a trade mark registration, the trade mark owner has the right to control the use of the trade mark. This includes the […]

2018-05-22

Dormant Company A dormant company is a company registered with ACRA (Accounting and Corporate Regulatory Authority) in Singapore, which has had no business activities in the past financial year and has no business income or business expenses (other than the basic expenses of keeping the company afloat). Such a company can be considered dormant. ACRA and the Inland Revenue Authority of Singapore also have policies in place for dormant companies. ACRA: Dormant companies: Are exempt from preparing corporate financial reports Can be exempted from holding annual general meetings Must still file an annual audit return, but the filing […]

2018-05-19

Business Secretary To run a company, in addition to a statutory secretary, you may need a commercial secretary. Singapore company business secretarial services include. Company mail collection and forwarding (customer bears postage costs) Assist clients in reviewing and processing incoming correspondence in English (with client authorization) **Authorization and disclaimer letters are required to process said correspondence. Customer parcel forwarding (customer bears the postage costs) Call forwarding, SMS, WeChat, email alert service Receiving of customers in the office General company operations consulting

2018-05-14

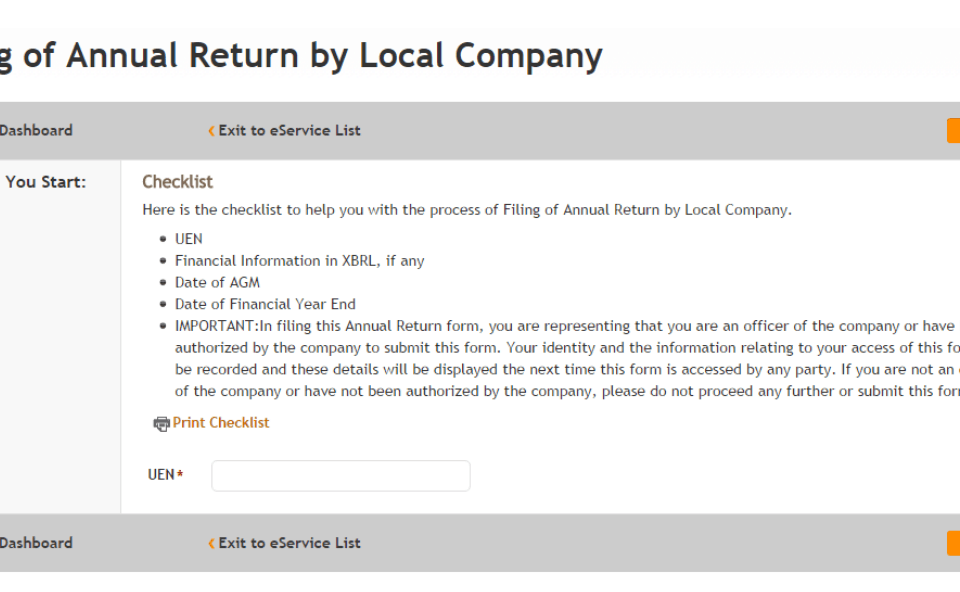

Annual Return Process Under the Singapore Companies Act, every Singapore company is required to file an annual return filing with the relevant government agency every year. These annual return requirements are mandatory and include the following: Preparation of accounts, completing the company’s accounts for the previous financial year in accordance with Singapore Accounting Standards. Prepare the company’s financial report per the Singapore Financial Reporting Standard (SFRS). Convene the Annual General Meeting (AGM) of the company. If the company is eligible, it can also apply to not hold an Annual General Meeting. It may choose to circulate the financial statements to […]

2018-05-02

Local Payments GIRO What is GIRO? The GIRO is a tripartite mechanism between the billing institution, the customer and the bank. The authorization of direct debits is a contractual relationship between the consumer and the purchase offer; the bank is the intermediary in this tripartite relationship and helps implement the authorized direct debits. Today, GIROs are widely used by consumers to pay bills to government agencies and the private sector. Direct transfers are particularly useful for payments that are fixed in nature and amount. In the public sector, GIRO has become the only means of payment for some fees, such […]

2018-04-27

Withholding Tax Requirements Who Are Non-Resident Companies or Individuals To determine whether withholding tax is applicable, the Payer has to ascertain that the payment was made to a company or an individual who is Non-Resident in Singapore. Non-Resident Company A company is either a tax resident or a non-resident of Singapore. In Singapore, the tax residency of a company is determined by the place in which the business is controlled and managed. “Control and management” is the making of decisions on strategic matters, such as those on company policy and strategy. Where the control and management of a company is […]

2018-04-24

Strike Off Company If a company in Singapore decides to cease doing business, it can apply to the Accounting and Corporate Regulatory Authority of Singapore (ACRA) to have its name removed from the Companies Register, a process known as “striking off”. Firstly, the company should pay unpaid taxes. For a company to successfully apply for cancellation of the company with ACRA, the company must not owe any tax liabilities and obligations to the Inland Revenue Authority of Singapore (IRAS), otherwise, the IRAS will oppose the company’s cancellation application. Therefore, a company must ensure that all outstanding tax obligations and liabilities […]